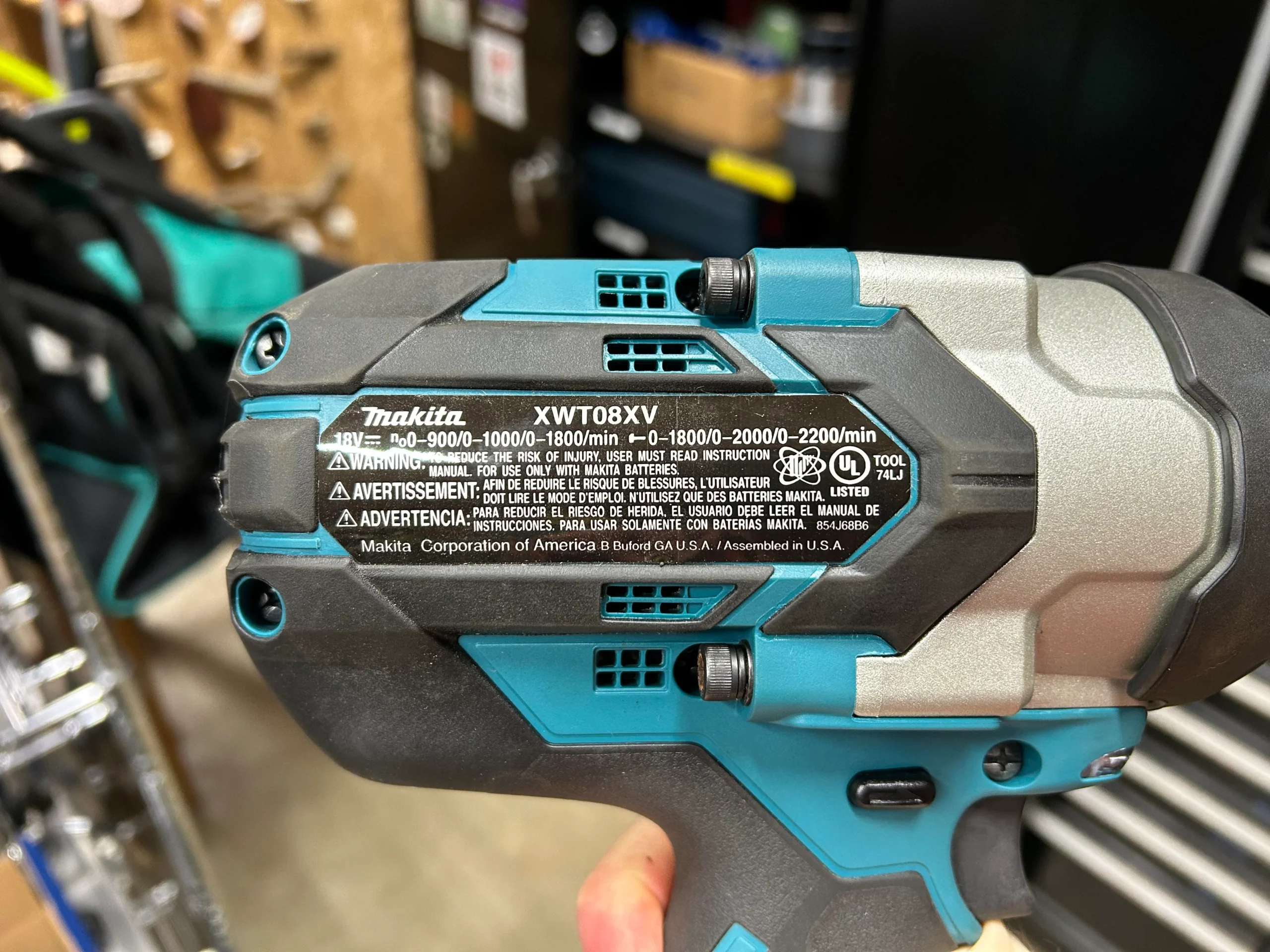

A tool’s origin label has a small voice. Buyers read it not out of curiosity but as a hint—whether a drill will stay solid in a contractor’s hands or quietly come back as a warranty claim months later. With Makita producing across multiple continents, the question of “where it’s made” becomes part of evaluating reliability, cost, and long-term performance. Makita’s structure is outlined in its global company overview[^1].

Table of Contents

- Why buyers care where Makita tools are built

- Differences between Japan, China and UK production lines

- What to inspect in a Makita OEM factory audit

- Evaluating build consistency, parts quality and long-term ROI

- Conclusion

- External References

Why buyers care where Makita tools are built

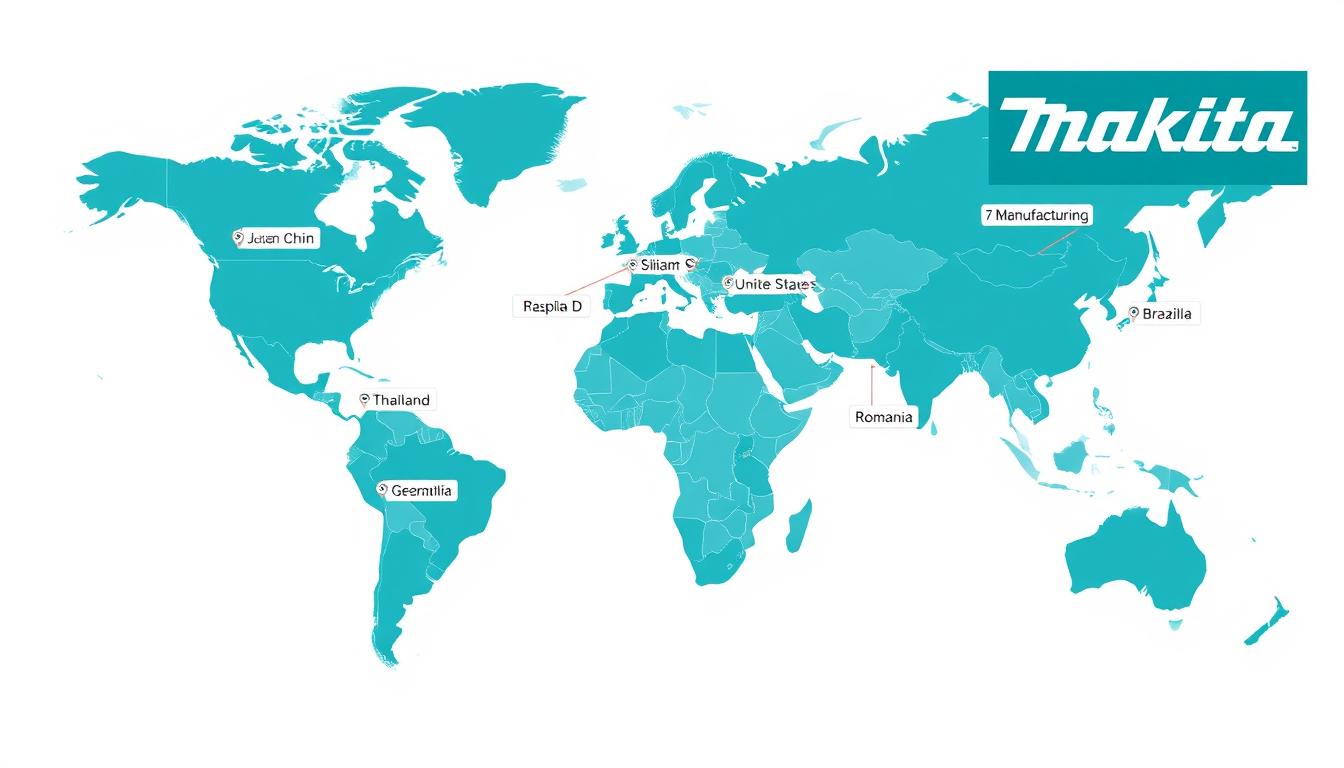

Makita now manufactures in eight countries—Japan, China, Romania, Thailand, Brazil, the USA, Germany, and the UK. Only about ten percent of Makita’s total output still comes from Japan.[^1][^2]

China contributes the largest portion, around sixty percent, driven by its large-scale Jiangsu facility, which sits inside one of China’s manufacturing clusters[^2].

Another thirty percent comes from regional plants in Europe, the Americas, and Southeast Asia.

That distribution matters to buyers because each region reflects a different industrial ecosystem. Jiangsu’s power-tool cluster is dense—motors, housings, gears, battery assembly, and testing labs all sit within a short distance. This makes production quick and cost-efficient. But not all factories inside this ecosystem are equal. Two workshops on the same street can deliver drastically different defect rates.

Most buyers I’ve met aren’t worried about the nationality of the label. They’re thinking ahead—whether a pallet of tools will survive a year with contractors, and whether after-sales costs will remain predictable.

| Criterion | Makita-Owned Plants | Jiangsu OEM Ecosystem |

|---|---|---|

| Quality control | Unified, brand-enforced | Inconsistent across factories |

| Engineering | Centralized by Makita | Often buyer-driven |

| Supplier stability | Long-term partners | Dense but uneven |

| Risk level | Predictable | Ranges from very low to very high |

Differences between Japan, China and UK production lines

Japan’s lines run with quiet precision—robotic systems and controlled environments suited for high-tolerance components, early pilot runs, and new-model validation. These techniques often align with established industrial automation standards[^3].

China operates with scale. Makita’s Jiangsu facility handles the bulk of mainstream cordless tools, supported by a deep local supply chain capable of fast throughput and competitive costs.

The UK, especially Makita’s Telford plant, focuses on adapting tools for EU/UK demands—region-specific configurations, compliance, voltage standards, and packaging aligned with EU machinery safety rules[^4].

Each country contributes something necessary: precision, volume, or proximity to market.

| Aspect | Japan | China (Jiangsu) | UK (Telford) |

|---|---|---|---|

| Role | R&D, pilot runs | Mass cordless production | Regional customization |

| Automation | High | Mixed | Moderate |

| Cost | Highest | Most efficient | Mid–high |

| Product type | Specialty SKUs | Global mainstream tools | EU/UK-specific kits |

What to inspect in a Makita OEM factory audit

In China, many OEM factories produce tools that resemble Makita’s cordless line—same silhouette, similar specs, and sometimes overlapping suppliers. But their consistency depends entirely on routine, not appearance.

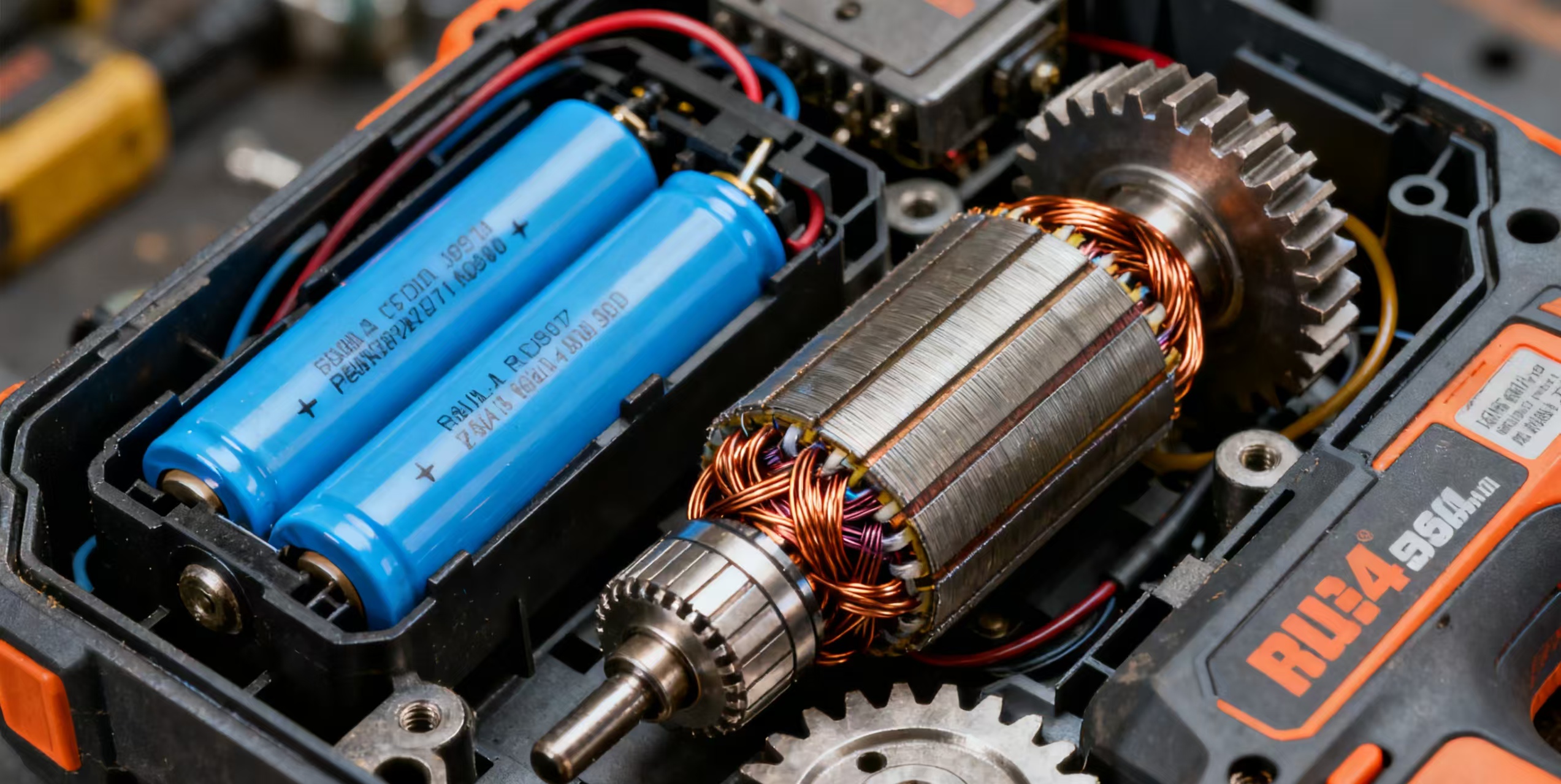

A meaningful audit starts with incoming components: motors, gears, battery cells, and housings. The next stop is battery pack assembly—spot welding, BMS calibration, pack balancing. These steps follow principles similar to battery management system guidelines[^5].

After that comes torque testing and functional checks, which align with common torque test procedures[^6].

And finally, the rework area reveals whether a factory learns from mistakes or simply patches them.

Factories that cut corners rarely hide it well.

| Step | What to Check | Why It Matters |

|---|---|---|

| Incoming parts | Motors, gears, cells | Prevents early failures |

| Battery assembly | Spot weld, BMS | Safety + lifespan |

| Torque tests | Batch sampling | Ensures real performance |

| Rework area | Failure trends | Shows systemic issues |

| Traceability | Batch codes | Essential for recalls |

Evaluating build consistency, parts quality and long-term ROI

A tool’s failure rarely comes from the obvious areas. More often it starts in overlooked details—battery cell grade, bearing precision, gear hardness, or motor balancing. Gear durability frequently relates to Rockwell hardness standards[^7].

Makita’s global network stays aligned through shared standards and test routines. OEM factories, in contrast, shift with the buyer’s budget and expectations.

In my experience, the buyers who treat QC as optional usually spend more on replacements later. Those who insist on stronger components and enforce test procedures end up with tools that quietly hold their ground in the field.

| Cost Element | What Buyers Miss | Practical Note |

|---|---|---|

| Battery cells | Cheap cells fade quickly | Require cycle-test reports |

| Motor & gears | Low-grade steel breaks early | Request supplier lists |

| QC time | Often shortened | Lock QC steps into PO |

| Packaging | Weak boxes cause damage | Run drop tests |

| Warranty impact | Underestimated | Calculate 3–5 year ROI |

Conclusion

Makita’s global production reflects a balance of precision, scale, and regional responsiveness. The origin label carries traces of the supply chain behind it—the steadiness of its parts, the discipline of its workers, and the consistency of its testing routines. Buyers sourcing Makita-style OEM tools face the same equation: shortcuts may look harmless at first, but the consequences surface months later.

Tools rarely fail loudly. Most decline quietly—in gear wear, heat buildup, cell fatigue. Those small details reveal how well the factory paid attention.

References

[^1]: Makita’s official global plant and network overview. ↩︎

[^2]: UNIDO documentation on industrial cluster structures. ↩︎

[^3]: ISO framework for industrial automation practices. ↩︎

[^4]: EU Commission page outlining machinery safety requirements. ↩︎

[^5]: IEEE reference on battery management system principles. ↩︎

[^6]: ASTM standard methods for torque testing fasteners. ↩︎

[^7]: ISO Rockwell hardness test specification for steels. ↩︎

Mr. Bai (Harlan) has more than a decade of experience in the power tool industry, starting with his father’s power tool factory. He has since created the Longi brand, which produces power tools that rival the best-known brands in the industry, but without the high price. In addition to this, the 29-year-old is also an avid traveler, having been to more than 20 countries, and he sees every experience as an opportunity to learn and grow. For him, life and work are all about constant discovery and improvement.