People often look for certainty in a label—“Made in the USA,” “Made in China,” “Assembled in Mexico.” But when I hold a DeWalt drill in my hand, the origin tells less of a story than the screws hidden beneath the casing. What matters is how many hands touched it, which factory tightened the final fasteners, and how deeply the brand trusted that line to carry its reputation.

DeWalt’s manufacturing footprint stretches across continents[^1]. A few tools still roll off American assembly lines, some proudly stamped “Made in the USA with global materials.”[^2] Many others come from Mexico, China, Brazil, Europe, and Southeast Asia—each site shaped by its own discipline, rhythm, and pressure.

A single sentence buyers want to know: DeWalt builds tools globally, and quality depends far more on process maturity than the passport of the plant.

Table of Contents

- Why DeWalt’s mixed manufacturing origins matter to buyers?

- Differences across US, Mexico and China production capabilities?

- Factory checks that confirm true DeWalt OEM consistency?

- Balancing durability expectations, service support and lifetime ROI?

- Conclusion

- References

Why DeWalt’s mixed manufacturing origins matter to buyers?

DeWalt’s global map is wide: US assembly plants across Maryland, Kentucky, the Carolinas, Tennessee, and Connecticut[^3]; major output from Mexico and China[^4]; specialty and older lines in Europe; and battery facilities expanding in the US.

But for buyers like us, origin is rarely the real question. What we want to know is whether that tool can last a contractor’s year, whether a fleet of thirty impact drivers will behave consistently, or whether warranty claims will ambush us six months in.

What I’ve seen across factories is simple:

Production location matters only when it reflects the system behind it.

Some US lines specialize in final assembly and flagship SKUs; Mexico handles stable, high-throughput platforms; China supplies deeply mature component ecosystems—motors, housings, gearboxes—that the entire global network depends on.

DeWalt’s “origin diversity” signals a brand relying on each region’s strengths rather than a single national identity.

False. Assembly location doesn’t override the quality of components—many of which are sourced globally, especially from Asia’s mature supply chain.

True. When motors, cells, and housings come from stable suppliers, production runs remain predictable, regardless of geography.

| Aspect | Why It Matters | DeWalt’s Reality |

|---|---|---|

| Parts sourcing | Determines baseline durability | Major share still from China + Asia |

| Assembly site | Affects traceability | US plants handle key models |

| Regional capacity | Impacts lead time | Mexico + China provide scale |

| QC culture | Impacts fleet-wide consistency | Varies by plant, not country |

Differences across US, Mexico and China production capabilities?

US plants concentrate on signature tools and battery packs—lines where brand image and engineering supervision must stay close. These facilities excel when the product needs strict validation, traceability, or regulatory alignment with North American standards[^5].

Mexico, on the other hand, is built for throughput. Its lines excel at long, stable production cycles with fewer model variations. I’ve seen Mexican plants produce runs that feel almost like the heartbeat of the brand—steady, predictable, cost-efficient.

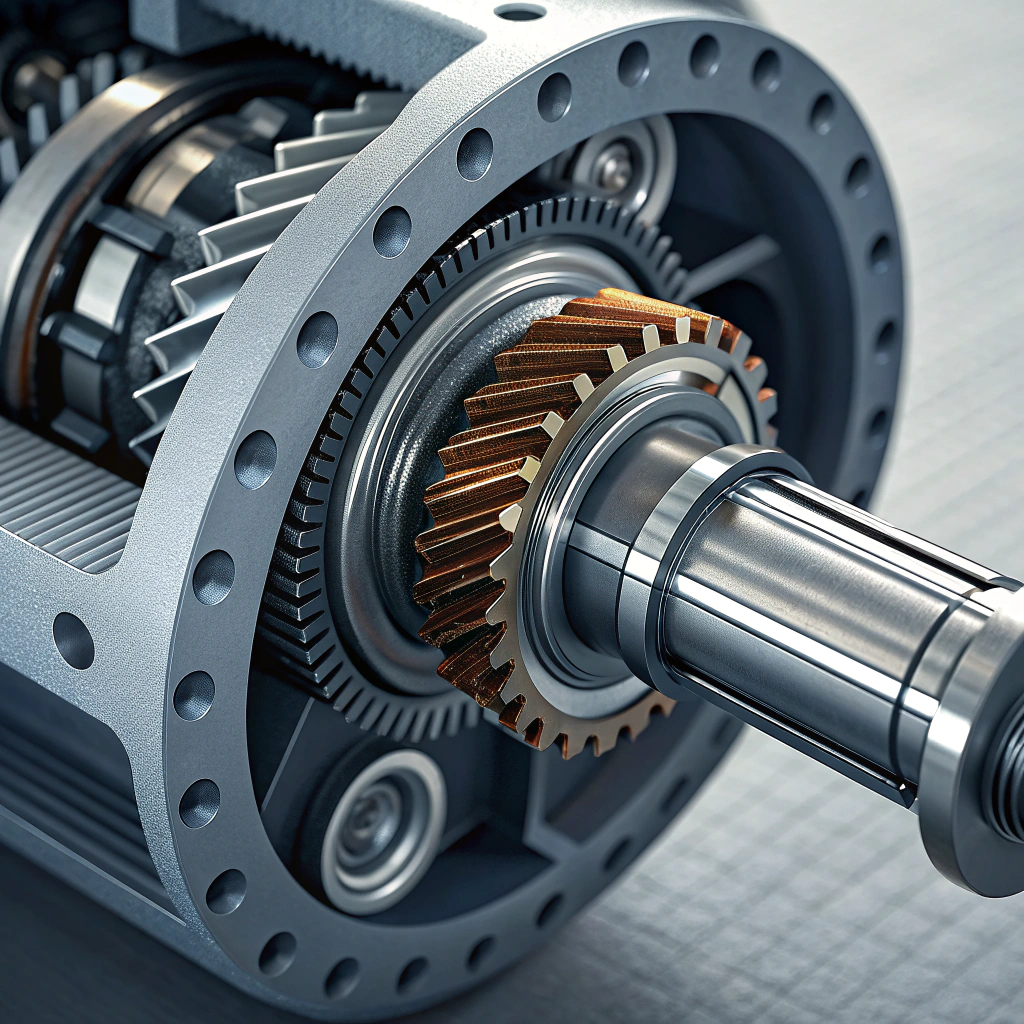

China remains the anchor of the component ecosystem. Not necessarily the final assembly, but the birthplace of motors, gearboxes, housings, and subassemblies that feed the entire global network. Without China’s supply chain, DeWalt’s global footprint would feel hollow.

False. Mexico runs some of the most stable long-run tooling lines, and China’s component precision often exceeds what final assembly alone can show.

True. DeWalt leverages them intentionally rather than competing them against each other.

| Country | Capability Strength | Typical Output |

|---|---|---|

| USA | Engineering oversight, battery lines, flagship kits | “Made in USA with global materials” models |

| Mexico | Long-run stability, cost-efficient cycles | Mid-range cordless + corded lines |

| China | Component manufacturing depth | Motors, housings, gears, battery enclosures |

Factory checks that confirm true DeWalt OEM consistency?

When I audit a DeWalt-compatible OEM in China or Mexico, I’m not looking at the shine of the building. I’m looking for the rhythm of the production floor—whether torque wrenches hang where they should, whether cell-welding sparks spit the right color, whether rework stations look like learning centers instead of dumping grounds.

A true audit follows the trail of components:

motors → gears → housings → battery cells → welding → BMS calibration[^6] → torque test → final run-in.

Factories that fear their mistakes usually hide them well.

Factories that understand their mistakes rarely do.

False. Samples are curated; only process discipline predicts real-world consistency.

True. Every bad production habit becomes a warranty claim eventually.

| Step | What to Verify | Why It Matters |

|---|---|---|

| Incoming QC | Motor data, gear hardness, cell grade | Stops failures at the gate |

| Battery welding | Spot strength + BMS programming | Safety + cycle life |

| Torque testing | Batch sampling accuracy | Prevents early breakage |

| Rework analysis | Defect categorization | Reveals systemic flaws |

| Traceability | Batch coding | Essential for fleet management |

Balancing durability expectations, service support and lifetime ROI?

Durability is rarely a dramatic event. Most tools don’t fail with smoke—they fade. Torque softens, cells lose bite, bearings whine in a way you can hear only if you’ve lived long enough with machines.

A tool’s ROI isn’t determined by where it was assembled. It comes from components: cell grade[^7], steel hardness, bearing tolerance, gear geometry. And from the quiet parts of the supply chain—spare parts availability, service turnaround, warranty clarity.

I’ve watched buyers choose the cheapest option in the moment and pay for it twice during the year. And I’ve seen fleets run smoothly for seasons simply because someone insisted on better cells and a documented QC path.

False. Samples prove potential—not discipline.

True. Good steel, good cells, and steady workflows make fleets cheaper to maintain.

| Cost Element | What Buyers Often Miss | Practical Note |

|---|---|---|

| Battery cells | Low-grade cells sag after few hundred cycles | Request cycle-life data + supplier names |

| Gears & bearings | Marginal hardness cuts life | Ask for hardness reports or spec sheets |

| Service network | “We’ll handle it later” | Confirm actual repair centers + turnaround |

| Spare parts | No guaranteed availability | Negotiate minimum support window |

| Warranty terms | Buyers only check headline years | Read exclusions; align with real use cases |

Conclusion

Whether a DeWalt tool comes from Maryland, Monterrey, or Guangdong, its reliability traces back to something quieter than geography: the steadiness of its supply chain, the honesty of its QC, and the habits of the people who build it. A label can tell you where it was assembled, but the feel of the trigger, the sound of the gearbox, and the life of the battery tell you where it truly came from.

References

[^1]: Wikipedia summary of DeWalt’s history and global manufacturing base. ↩︎

[^2]: DeWalt official page explaining “Made in the USA with global materials.” ↩︎

[^3]: Assembly Magazine feature describing DeWalt’s U.S. factory locations and output. ↩︎

[^4]: MPR Tools breakdown of DeWalt’s worldwide plants and key countries. ↩︎

[^5]: OSHA guidance on hand and power tool safety requirements in North America. ↩︎

[^6]: Monolithic Power Systems article on battery management system design principles. ↩︎

[^7]: Intertek overview of IEC 62133 lithium-ion safety testing requirements. ↩︎

Mr. Bai (Harlan) has more than a decade of experience in the power tool industry, starting with his father’s power tool factory. He has since created the Longi brand, which produces power tools that rival the best-known brands in the industry, but without the high price. In addition to this, the 29-year-old is also an avid traveler, having been to more than 20 countries, and he sees every experience as an opportunity to learn and grow. For him, life and work are all about constant discovery and improvement.