Black+Decker[^1] has always felt like a brand built for ordinary households, yet its footprint spans continents like a quiet giant. Buyers rarely see these factories, but I’ve stood in a few of them—humid workshops in southern China, steady-paced lines in Mexico, and older but disciplined facilities in the U.S. Every place leaves a different fingerprint on the tools, though the label alone never tells the whole story.

A concise answer buyers often look for:

Black+Decker tools come from a global mix of U.S., Mexico, Brazil, China, and U.K. facilities, with high-volume models shifting increasingly toward North America and away from China since recent tariff changes.

Table of Contents

- Why Black+Decker’s global production mix matters to buyers?

- Comparing China, Mexico and US manufacturing capabilities?

- Checks to verify Black+Decker OEM process stability?

- Balancing cost targets with durability and long-term ROI?

- Conclusion

- References

Why Black+Decker’s global production mix matters to buyers?

Production locations shift, but expectations don’t. U.S. buyers often imagine their tools sailing across a single supply chain, yet Black+Decker’s world is more entangled: U.S. assembly for some units, Mexico for mass-market kits, China for breadth and cost, Brazil for regional distribution, and U.K. plants holding older European channels[^2]. The structure matters because it shapes consistency—how predictable your next shipment will be, and how confidently you can promise a retailer your defect rate.

From what I’ve seen, being part of Stanley Black & Decker[^3] changed the brand’s temperament. It became steadier, less impulsive. Processes tightened. And its factories—especially those in China and Mexico—function like well-oiled gears inside a larger system rather than isolated workshops.

A quick comparison of production regions

| Region | Strength | Limitation |

|---|---|---|

| U.S. | Brand value, key assemblies, specialty tools | Higher labor cost |

| Mexico | High-volume, stable throughput | Limited advanced R&D |

| China | Broad supply chain, lowest cost-pressure | Tariff exposure for U.S. |

Comparing China, Mexico and US manufacturing capabilities?

China builds scale like no other. Suzhou alone could supply enough motors and housings for dozens of brands. The secret is not cheapness but speed—molds revised overnight, parts delivered before morning shifts, entire assembly lines rebalanced within days.

Mexico, meanwhile, performs with a quieter rhythm. It absorbs the volume flowing away from China due to tariffs[^4], and for U.S. buyers, it shortens transit time in ways that directly improve cash flow.

And then there’s the U.S.—strong in symbolic products and specialty assemblies. Not everything is built there, but what is built tends to represent the face of the brand. I’ve walked those lines; the mood is different, more careful, sometimes slower, but intentional.

Regional capability snapshot

| Capability | China | Mexico | U.S. |

|---|---|---|---|

| High-volume production | ★★★★★ | ★★★★☆ | ★★☆☆☆ |

| Lead-time to U.S. market | ★★☆☆☆ | ★★★★★ | ★★★★★ |

| Supply chain maturity | ★★★★★ | ★★★☆☆ | ★★★★☆ |

| Cost efficiency | ★★★★★ | ★★★★☆ | ★★☆☆☆ |

Checks to verify Black+Decker OEM process stability?

Audit work feels like detective work—listening to machines, watching hands, tracing parts. Black+Decker factories under Stanley Black & Decker lean on group standards, but OEM environments outside the group vary wildly.

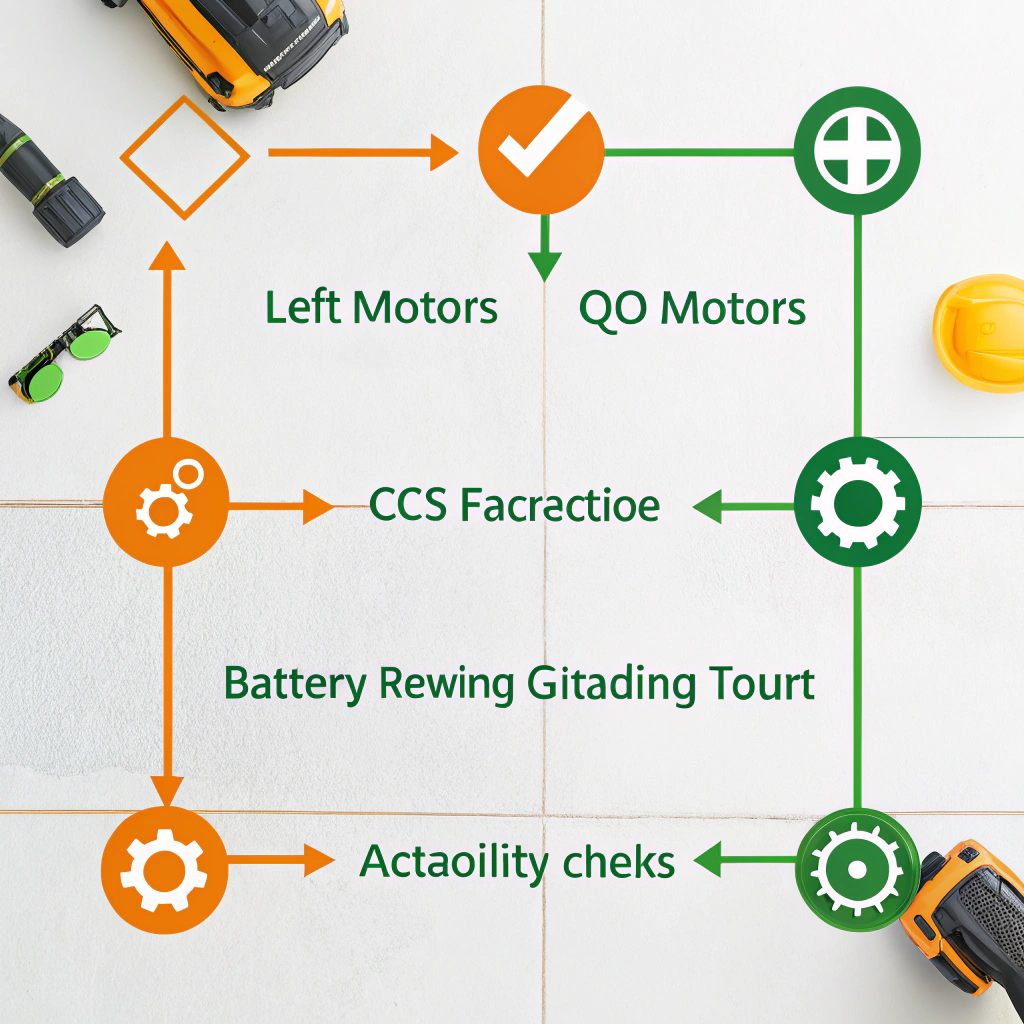

A proper evaluation always starts with simple questions:

How do they receive motors? Who certifies their gears? Do they run cell-grading for batteries[^5] or simply trust suppliers?

The answers decide half the defect rate long before assembly starts.

Key factory checks

| Step | What to Verify | Why It Matters |

|---|---|---|

| Incoming QC | Motor grade, gear hardness, plastics | Determines baseline durability |

| Battery processes | Cell matching, weld quality | Safety + cycle life |

| Torque testing | Batch sampling discipline | Real-world performance |

| Rework zone | Error types & recurrence | Shows systemic weaknesses |

| Traceability[^6] | Batch codes, serials | Critical for warranties |

Balancing cost targets with durability and long-term ROI?

Black+Decker plays in the mass-market field, but even budget tools need dependable bones. Cost pressure is constant across China, Mexico, Brazil, and U.S. assembly lines. What differs is how each region negotiates the tradeoff between price and reliability.

I’ve met buyers who chased the cheapest versions and paid double later in replacements. And others—usually quieter, more methodical—who demanded stronger steel, better cells, longer QC routines. Their products lasted. Their customers returned.

Cost vs durability matrix

| Cost Element | What Buyers Miss | Practical Note |

|---|---|---|

| Battery cells | Low-grade cells die early | Require cycle testing[^7] |

| Gear hardness | Cheap steel cannot last | Verify hardness reports |

| Motor quality | Balancing affects heat & noise | Request supplier list |

| QC time | Often trimmed | Lock testing steps in PO |

| Packaging | Tool damage in transit | Run drop tests |

Conclusion

Black+Decker’s tools come from many corners of the world, but what binds them together is the quiet machinery of Stanley Black & Decker’s global system. A tool never tells you its entire story; its birthplace is only one chapter. The truth shows up later—how long the motor hums, how steady the gears stay, how many customers return not with complaints but with repeat orders.

Some tools fail loudly, others fade quietly. The ones that endure come from factories where people care enough to tighten one more screw, check one more weld, and reject one more weak cell. That’s what buyers are really paying for.

References

[^1]: Wikipedia overview of the Black+Decker brand, history and product range. ↩︎

[^2]: Black+Decker support FAQ listing US, Mexico, Brazil, China and UK manufacturing sites. ↩︎

[^3]: Stanley Black & Decker story on global reach after merging with Black & Decker. ↩︎

[^4]: CT Insider coverage of Stanley Black & Decker’s tariff response and China-to-Mexico shifts. ↩︎

[^5]: Intertek page describing battery testing, grading and performance verification services. ↩︎

[^6]: ISO 9001 overview explaining quality management systems and traceability requirements. ↩︎

[^7]: Intertek FAQ on IEC 62133 cycle testing for lithium-ion batteries in portable tools. ↩︎

Mr. Bai (Harlan) has more than a decade of experience in the power tool industry, starting with his father’s power tool factory. He has since created the Longi brand, which produces power tools that rival the best-known brands in the industry, but without the high price. In addition to this, the 29-year-old is also an avid traveler, having been to more than 20 countries, and he sees every experience as an opportunity to learn and grow. For him, life and work are all about constant discovery and improvement.